Improved Geological Confidence in Copper and Gold Mineralization

Alacran Deposit Remains Open for Resource Expansion

TORONTO, ONTARIO, February 26, 2018: Cordoba Minerals Corp. (TSX-V:CDB; OTCQX:CDBMF) (“Cordoba” or the “Company”) is pleased to announce an updated Mineral Resource estimate for the Alacran Deposit, located within the 100%-owned San Matias copper-gold project in Colombia.

Highlights

- The updated, conceptual pit-constrained, Mineral Resource for the Alacran Deposit includes 36.1 million tonnes of Indicated Resources grading 0.57% copper and 0.26 g/t gold (0.72% copper equivalent; “CuEq”), and 31.8 million tonnes of Inferred Resources grading 0.52% copper and 0.24 g/t gold (0.65% CuEq) at a 0.28% CuEq cut-off.

- Indicated Resources contain 454 million pounds of copper and 300,000 ounces of gold, and Inferred Resources contain 365 million pounds of copper and 250,000 ounces of gold.

- The Alacran Deposit is expected to have low capital intensity given the highly favourable 1.17:1 strip ratio of the conceptual pit-constrained resource. This is due to the geometry of the deposit and its location along a ridgeline.

- High-grade diamond drill intercepts associated with carbonate-base metal (“CBM”) veins, which have been identified over 600 metres of strike length, were excluded from the geological model, but the sample values were retained and capped in the resource calculation. Specific high-grade intercepts, such as 4,440 g/t gold, 10.25% copper, 347 g/t silver, and 24.70% zinc over 0.9 metres in ACD036 (previously reported January 23, 2017), have been capped at 1% copper and 2 g/t gold in the updated resource estimate.

- Drilling will also target copper and gold mineralization to the south that was not included in the pit-constrained resource.

- The Alacran north-south structural corridor has been mapped over 3 kilometres south of Alacran with similar host stratigraphy and new copper mineralization identified.

“We have improved our understanding of the Alacran Deposit through the 2017 drill program, leading to updated modelling parameters and improved geological confidence in our resource estimate. We have been successful in significantly increasing tonnage and have classified a significant portion as Indicated Resources,” commented Mario Stifano, President and CEO of Cordoba Minerals. “However, there is still more to learn about the Alacran Deposit, leaving the potential for further high-grade discoveries. Alacran remains open down-dip and along-strike to the northwest. We will continue to explore the Alacran Deposit in 2018 and will work towards completing a preliminary economic assessment in the second half of 2018. Additionally, our geologists have identified a number of high priority targets within the San Matias district that we will continue to explore, as we look to complement the Alacran Deposit.

Table 1: Alacran Mineral Resource estimate as at February 20, 2018

| Classification | CuEq Cut-Off (%) |

Tonnage (Mt) |

Grades | Contained Metals | |||

|---|---|---|---|---|---|---|---|

| CuEq (%) |

Copper (%) |

Gold (g/t) |

Copper (Mlb) |

Gold (koz) |

|||

| Indicated | 0.28 | 36.1 | 0.72 | 0.57 | 0.26 | 454 | 300 |

| Inferred | 0.28 | 31.8 | 0.65 | 0.52 | 0.24 | 365 | 250 |

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- The Mineral Resources in this estimate were independently prepared by Peter Oshust, P.Geo. of Amec Foster Wheeler Americas Limited, following the Definition Standards for Mineral Resources and Mineral Reserves Prepared by the CIM Standing Committee on Reserve Definitions, adopted by CIM Council on May 10, 2014.

- The Mineral Resources in this estimate are constrained within a conceptual pit shell developed using Whittle™ software. Assumptions used to prepare the conceptual pit include:

- Metal prices of US$3.15/lb copper and US$1,400/oz gold;

- Mining cost of US$2.00/t mined;

- Processing cost of US$12/t milled;

- G&A costs of US$1.25/t milled;

- 100% mining recovery, 0% dilution, and 45° pit slope;

- Process recoveries of 90% for copper grades greater than 0.4%, 75% for copper grades less 0.4%, and 70% for gold;

- Freight and treatment costs of US$162/t concentrate;

- Payable metal factors of 96% for copper and 95% for gold;

- Refining charges of US$0.085/lb copper and US$5.50/oz gold.

- Copper equivalent has been calculated using: copper grade (%) plus 0.504 x gold grade (g/t) for copper grades greater than 0.4%, and copper grade (%) plus 0.605 x gold grade (g/t) for copper grades less than 0.4%.

- The cut-off grade of 0.28% CuEq is a marginal cut-off sufficient to cover US$12.00/t processing costs and $1.25/t G&A costs.

Cordoba has been successful in upgrading 36.1 million tonnes of Mineral Resources into the Indicated Resources category. This compares to the previous Alacran Mineral Resource estimate (refer to Cordoba’s news release dated January 5, 2017) that only contained Inferred Resources. There still remains 31.8 million tonnes classified as Inferred Resources in the updated estimate.

CBM veins intersected by drilling and associated with very high-grade gold mineralization were excluded from the current geological model, but the sample values were retained and capped in the resource calculation, due to the low resolution of the drill hole spacing relative to the narrow veins. Further investigation into these features may allow for better local prediction of gold grades within the deposit.

The Alacran north-south structural corridor has been mapped over 3 kilometres south of Alacran with similar host stratigraphy and new copper mineralization identified.

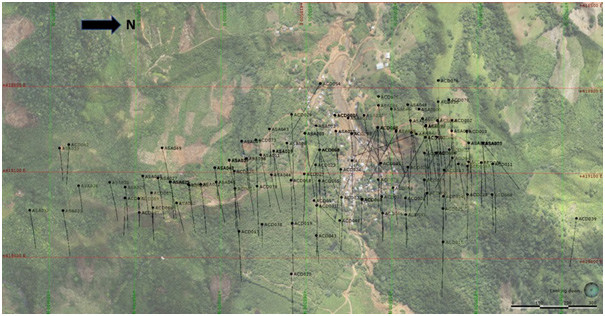

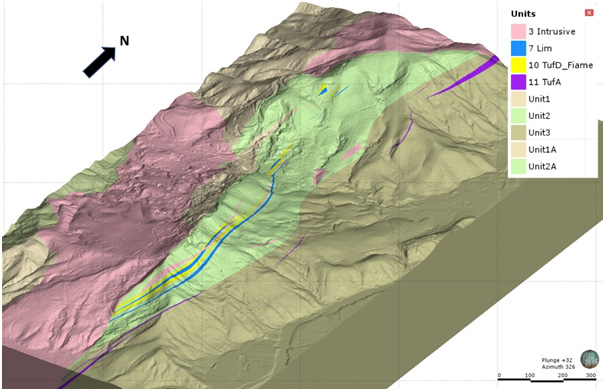

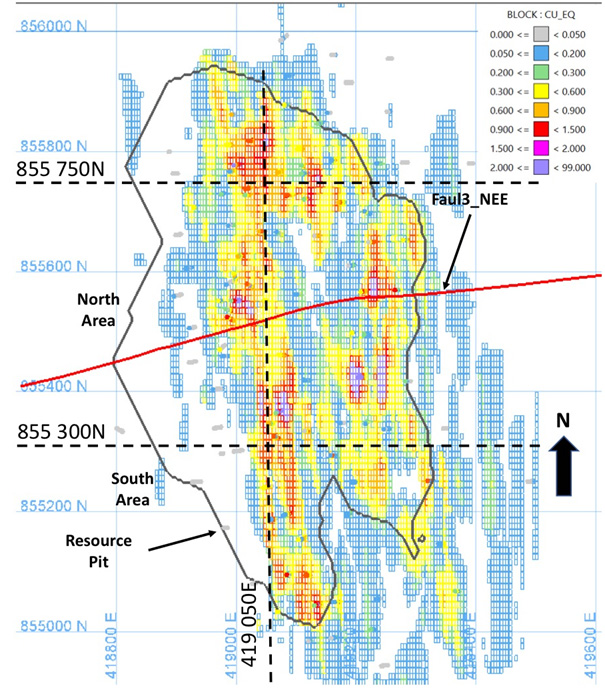

There is evidence of many structural offsets of marker horizons from minor to significant on a deposit scale. Three faults were identified and modelled for the updated resource estimate. The most dominant structure is the Faul3_NEE fault which marks the boundary between the north and south areas of the Alacran Deposit. The north area was previously referred to as Mina Norte and the south as Mina Sur in earlier reports.

The process recovery assumptions used in the resource modelling were based on the results of metallurgical recovery test work of two composites with grades greater than 1.0% copper. Current metallurgical test work has not been completed to support the impact of grade variability on metallurgical recovery.

Rock Quality Designation (“RQD”) measurements were collected from drill core during logging, but a detailed geotechnical analysis has not been completed to support the current pit slope assumptions.

Mineral Resource Estimation Methodology

The updated Mineral Resource estimate for the Alacran Deposit has been prepared by Amec Foster Wheeler Americas Limited (“AMEC”). The updated Mineral Resource estimate is based on geology and assay data from 136 diamond drill holes totalling 35,900 metres completed by Cordoba and previous operators between 2012 and 2017. Assay data is available for 130 of the completed holes. The cut-off date for drill hole information was December 15, 2017.

A 5x10x5 metre block size was chosen for the resource block model to reflect mining selectivity for a potential 12,750 tonne per day mining scenario. The resource block model was sub-blocked to 2.5x5.0x2.5 metre blocks to maintain geological resolution. The block grade model was flagged for lithological and structural domains from wireframes from the geological model.

Inverse Distance to the third power (“ID3”) was used for high-grade copper and gold indicator probability modelling and block grade estimation. Ordinary Kriging (“OK”) was used for Specific Gravity (“SG”) indicator probability modeling, and OK and Simple Kriging (“SK”) was used for SG estimation. SK was used for the final estimation pass for density. The average density for each estimation domain was used as the SK stationary mean.

For a detailed discussion of the Mineral Resource estimation methodology refer to the National Instrument 43-101 compliant technical report expected to be filed on www.sedar.com within 45 days.

Cut-Off Grade Sensitivity

Indicated and Inferred Mineral Resources have been calculated at various copper equivalent cut-off grades to demonstrate the sensitivity of tonnage and grades. The reporting base case of 0.28% CuEq is highlighted.

Table 2: Alacran Mineral Resource Cut-Off Grade Sensitivity

| Classification | CuEq Cut-Off (%) |

Tonnage (Mt) |

Grades | Contained Metals | |||

|---|---|---|---|---|---|---|---|

| CuEq (%) |

Copper (%) |

Gold (g/t) |

Copper (Mlb) |

Gold (koz) |

|||

| Indicated | 0.20 | 42.5 | 0.64 | 0.51 | 0.24 | 478 | 330 |

| 0.22 | 40.9 | 0.66 | 0.53 | 0.24 | 478 | 320 | |

| 0.24 | 39.3 | 0.68 | 0.54 | 0.25 | 467 | 320 | |

| 0.26 | 37.7 | 0.70 | 0.56 | 0.26 | 465 | 310 | |

| 0.28 | 36.1 | 0.72 | 0.57 | 0.26 | 454 | 300 | |

| 0.30 | 34.6 | 0.73 | 0.59 | 0.27 | 450 | 300 | |

| 0.32 | 33.0 | 0.75 | 0.61 | 0.28 | 444 | 300 | |

| 0.35 | 30.9 | 0.78 | 0.63 | 0.29 | 429 | 290 | |

| 0.40 | 27.6 | 0.83 | 0.67 | 0.31 | 407 | 270 | |

| Inferred | 0.20 | 41.2 | 0.56 | 0.44 | 0.21 | 400 | 280 |

| 0.22 | 38.7 | 0.58 | 0.46 | 0.22 | 392 | 270 | |

| 0.24 | 36.3 | 0.60 | 0.48 | 0.23 | 384 | 270 | |

| 0.26 | 34.0 | 0.63 | 0.50 | 0.23 | 375 | 250 | |

| 0.28 | 31.8 | 0.65 | 0.52 | 0.24 | 365 | 250 | |

| 0.30 | 29.9 | 0.68 | 0.54 | 0.25 | 356 | 240 | |

| 0.32 | 28.1 | 0.70 | 0.56 | 0.26 | 346 | 230 | |

| 0.35 | 25.6 | 0.73 | 0.59 | 0.27 | 333 | 220 | |

| 0.40 | 22.0 | 0.79 | 0.64 | 0.29 | 310 | 210 | |

San Matias Regional Exploration

Cordoba has resumed district-scale exploration for additional porphyry and iron oxide copper-gold (IOCG) systems in the San Matias district and along its potential extensions. Current exploration targets include combinations of geochemical and geophysical anomalies in favourable structural-lithological settings.

In addition to the Company’s 20,000-hectare land-package at San Matias, Cordoba holds an additional 34,342 hectares of mining concessions and exploration licenses covering the outcropping portion of the Cretaceous-age magmatic arc to the west, east and south of the San Matias district. Only a small portion of this prospective regional geology has been mapped and/or covered by geochemical and geophysical surveys. The Company believes the geological potential of these areas is high.

Corporate Update

On January 23, 2018, Cordoba entered into an Amendment Agreement to the Option Agreement between Cordoba Minerals, Minerales Cordoba S.A.S., Sociedad Ordinaria de Minas Omni (“OMNI”), Compañia Minera El Alacran S.A.S., CMH Colombia S.A.S., Cobre Minerales, and Exploradora Cordoba S.A.S. dated February 27, 2016, to extend the exploration period pursuant to the Option Agreement by two years in order to file a larger mine plan with a capacity of more than 2.0 million tons per year with the National Mining Agency of Colombia. In accordance with the Amendment Agreement, Cordoba will file the request for the requisite approvals to conduct activities of construction and commercial production at El Alacran on or before June 30, 2020.

Additionally, the total option payment remains set at $14.0 million, and Cordoba will make an advance payment of $1.0 million to OMNI on February 27, 2019 and the remaining $13.0 million will be payable on June 30, 2020.

Subject to regulatory approval, Cordoba has arranged for a short term loan of $1 million from HPX bearing interest of 10% per annum, which will be used to make an option payment to OMNI and for general working capital purposes.

With the conclusion of the 2017 exploration program at Alacran and the completion of the updated Mineral Resource estimate, Eugenio Espada, Vice President, Exploration will be stepping down from his position with the Company. Mr. Espada will continue to advise Cordoba Minerals as a consultant and will assist during the transition period of his replacement.

Technical Information & Qualified Person

The Mineral Resources in this estimate were independently prepared by Peter Oshust, P.Geo of AMEC. Greg Kulla, P.Geo, also an employee of AMEC, verified the drill hole database supporting the Mineral Resource estimation. Verification included a site visit to inspect drilling, logging, density measurement, and sampling procedures, and a review of the control sample results used to assess laboratory assay quality. In addition, a random selection of the drill hole database results was compared with original records.

The technical information in this release has been reviewed and verified by Dale A. Sketchley, M.Sc., P.Geo., a Qualified Person for the purpose of National Instrument 43-101. Mr. Sketchley is a consultant to Cordoba Minerals and is considered independent under National Instrument 43-101. Mr. Sketchley is a geologist with over 40 years in the mineral exploration, mining, and consulting industry. He is a Member of the Association of Professional Engineers and Geoscientists of British Columbia (APEGBC) and the Canadian Institute of Mining and Metallurgy (CIMM).

Alacran Copper-Gold Project

The Alacran copper-gold system is located within the San Matias copper-gold project in the Department of Cordoba, Colombia, 200 kilometres north of Medellin. San Matias comprises a 20,000-hectare land-package and contains several known areas of porphyry copper-gold, IOCG, carbonate replacement and gold vein mineralization.

The Alacran copper-gold system is located on a topographic high in gently rolling countryside, optimal for potential open-pit mining. Site access and infrastructure are considered to be favourable.

Alacran is approximately two kilometres southwest of the Company’s Montiel porphyry copper-gold discovery, where drilling intersected 1.0% copper and 0.65 g/t gold over 101.1 metres (previously reported in DDH-004), and two kilometres northwest of the Costa Azul porphyry copper-gold discovery, where drilling intersected 0.62% copper and 0.51 g/t gold over 86.6 metres (previously reported in CADDH003).

The copper-gold mineralization at Alacran is associated with stratabound replacement of a faulted calcareous marine volcano-sedimentary sequence. The deposit comprises moderately- to steeply-dipping stratigraphy that is mineralized as a series of sub-parallel replacement-style zones and associated disseminations. The mineralization comprises multiple overprinting hydrothermal events, and the main mineralizing phase comprises chalcopyrite-pyrrhotite-pyrite that appears to overprint an early magnetite metasomatic event.

About Cordoba Minerals

Cordoba Minerals Corp. is a Toronto-based mineral exploration company focused on the exploration and acquisition of copper and gold projects in Colombia. Cordoba is currently focused on its 100%-owned San Matias Copper-Gold Project, which includes the advanced-stage Alacran Deposit located in the Department of Cordoba. For further information, please visit www.cordobaminerals.com.

ON BEHALF OF THE COMPANY

Mario Stifano, President and CEO

Cordoba Minerals Corp.

For further information, please contact:

Evan Young, Director, Investor Relations

Email: eyoung@cordobamineralscorp.com

Phone: +1 (647) 808-2141

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the potential of the Company’s properties are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which Cordoba operates, are inherently subject to significant operational, economic, and competitive uncertainties and contingencies.

Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, "forecast", “expect”, "potential", "target", "schedule", budget" and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. Forward-looking statements include, without limitation, (i) that there remains potential to expand and increase the scale of the current mineralized resource; (ii) that high-grade vein intercepts could provide additional upside; (iii) that Alacran will have low capital intensity due to low expected strip ratio; (iv) that significant copper mineralization will be identified in the structural corridor 3 kilometres south of Alacran; and (v) that a Preliminary Economic Assessment at Alacran will be completed in the second half of 2018. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators.Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated.

There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements which speak only as of the date of this news release.The Company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

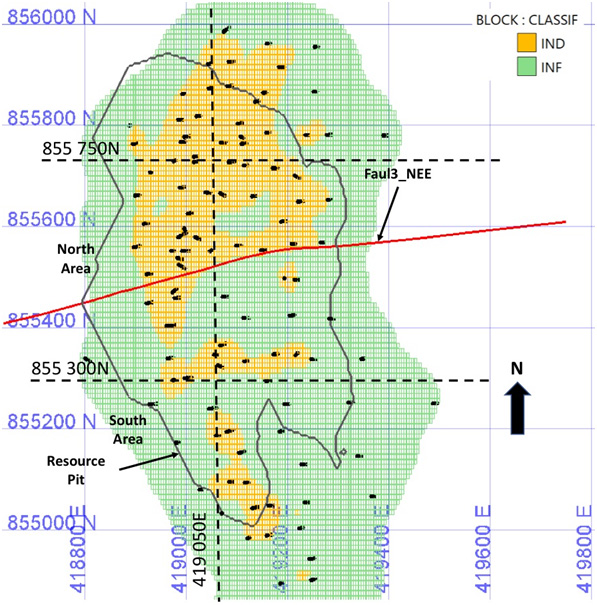

Figure 1: Satellite Photo of the Alacran Deposit Area with Drill Hole Locations and Traces

Figure 2: 3D Leapfrog Geological Model

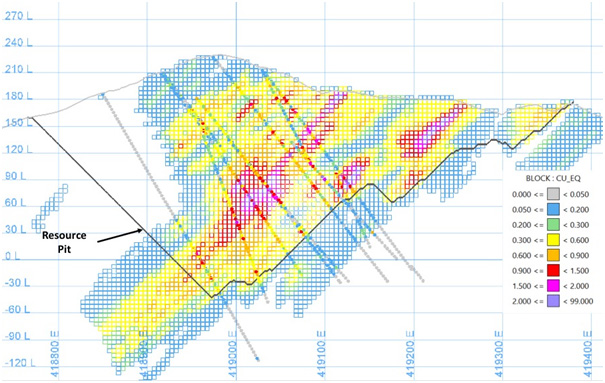

Figure 3: CuEq Block Grade Model Map at 102.5 RL ± 7.5 m

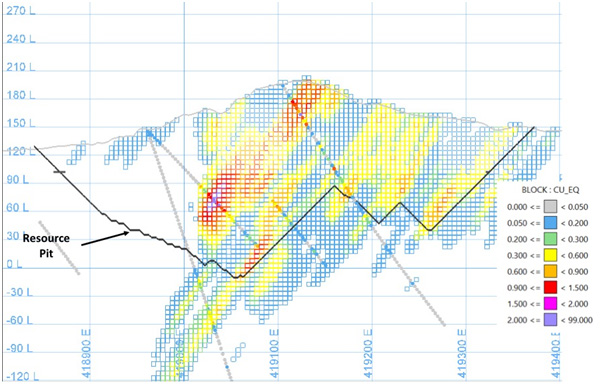

Figure 4: CuEq Block Grade Map at 855 750 N ± 25 m

Figure 5: CuEq Block Grade Map at 855 300 N ± 25 m

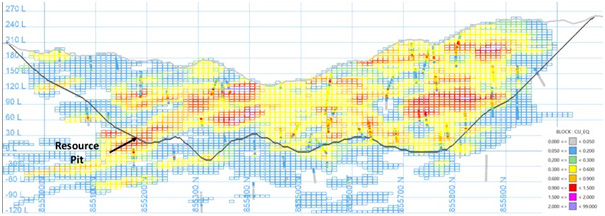

Figure 6: CuEq Block Grade Map at 419 050 E ± 12.5 m

Figure 7: Block Classification Map at 102.5 RL ± 7.5 m